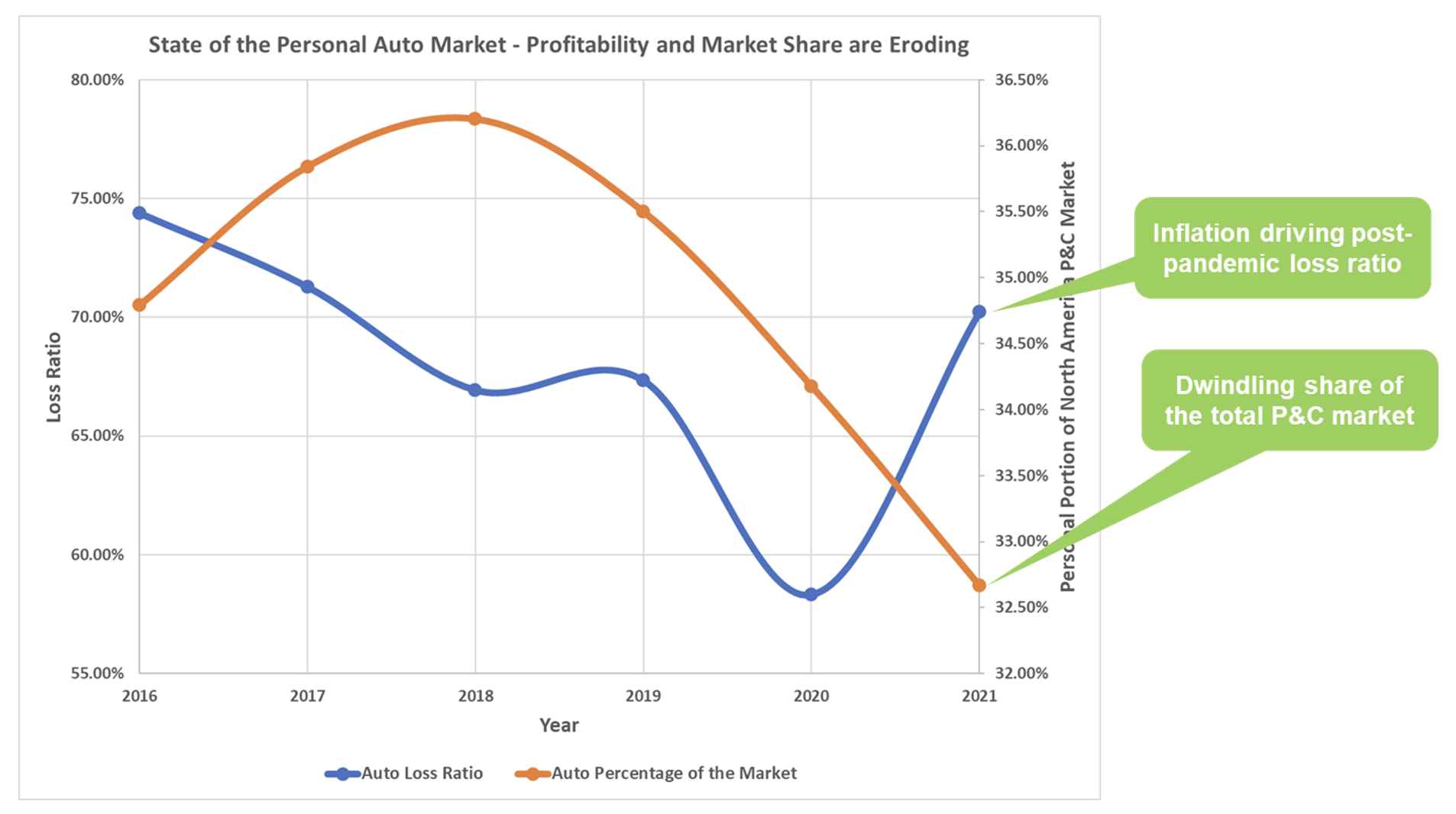

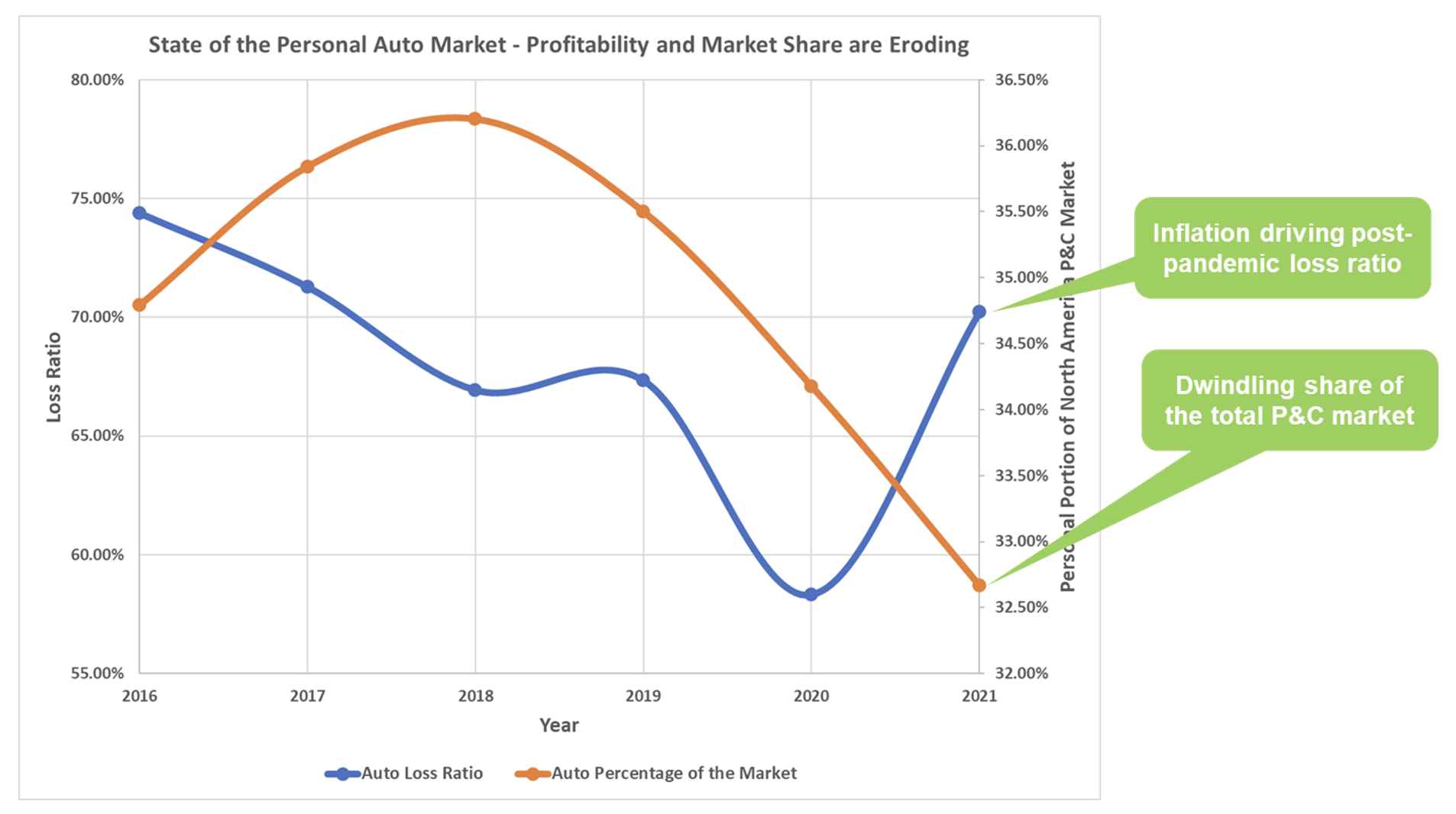

The Dwindling Personal Auto Market is a Harbinger of More Change to Come

The U.S. personal auto insurance industry faces unprecedented levels of contraction and profitability erosion. In the past four years, the personal auto market’s share of the entire P&C industry has faced year-over-year declines, starting at 36.20% in 2018 and falling to 32.56% in 2021. While the prospects of the personal auto business look grim, the P&C market in its entirety tells a less dramatic story, with premium volumes tracking more closely with inflation while enjoying a relatively stable loss ratio.

New Variants of Risk Enter the Market and Agility in Product Pricing Become More Important Than Ever

My recent attempt to rent a car through Turo sheds some light as to what is happening in the auto market. Turo being a car-sharing platform disrupting the traditional car rental market, this experience was a tangible illustration of personal auto risk transforming to commercial auto risk. While a typical personal auto policy covers rental cars from the likes of Hertz, my insurer strongly advised me to purchase additional insurance through Turo as the licensed agent on the phone would not to commit to covering Turo-related claims. With major commercial carriers such as Liberty Mutual backing policies issued through turo.com, the premium diversion is clear.

Movement of premium dollars from personal to commercial risk is more than a shift in cash flow reporting, it reflects a fundamental shift in exposure requiring a fresh look from an actuarial perspective:

• What does litigation look like when the rental “agency” is nothing more than an online platform connecting drivers to individual vehicle owners?

• How is the risk profile of a host with one car different from that of a host with 85 cars?

• Do “guests” using Turo to find a rental pose the same level of risk as that of the ‘typical’ driver going to a brick-and-mortar rental agency?

Answers to these sorts of questions hinge on pricing and underwriting insights as more loss experience accumulates from the car sharing economy.

The Future of Pricing Sophistication – More Models … Unmanageable with Traditional Approaches

While the insurance industry undergoes inevitable and perpetual structural changes – such as what is happening in the personal and commercial auto risk markets – we must remember that fundamentally, any risk can be profitable so-long as it priced appropriately. As elaborated upon in the previous blog “Path to Profitability with More Agile Pricing”, this timeless adage underscores the critical role of pricing in insurers’ profitability and market share.

Chief Actuaries in the P&C business are realizing that AI-enabled model proliferation is the future of pricing. Previously a pipe dream, the notion of building and maintaining the 1000’s (at a minimum) of models required to tailor pricing for each coverage / state / legal entity combination is now a much more feasible endeavor. Realizing this enlightened future state hinges on three key capabilities. The first is cost-efficient, timely, and unfettered access to all the relevant data regardless of where it resides, keeping in mind even internal sources are often federated across many platforms and clouds. The second is automation of the tedious model building tasks that beleaguer a typical analytics process. Thirdly, a mechanism to embed models into customer-facing business processes while maintaining robust lineage to originating data and assumptions.

Embracing Data Led Transformation to Achieve Pricing Excellence

Data – the foundational prerequisite to enable agile pricing – is more diverse and dispersed than ever. As organizations increasingly recognize the operational risk and financial cost of perpetual data movement, organizations seek technical capabilities that enable business value to be extracted from data where it resides.

Teradata’s ClearScape Analytics and High-Speed Data Fabric accomplish this very objective – allowing organizations to spend more time on insights development and less on babysitting the data. Whether for a pure premium prediction or pricing elasticity model, Teradata’s 150 in-database analytic functions enable all users to perform analytics at the data. And when more data from across the ecosystem is required, QueryGrid and Native Object Store fill in the gaps while maintaining high levels of trust in data quality.

The insurance market is ever changing but with the right technology to get at the right data all the time, carriers can bolster their competitive advantage through data led business transformation.